CmaBoardReleases

Title: Press Release: The Capital Markets Authority Prepares its Regulations for Financial Technologies and Issues Module Nineteen (Financial Technologies) of the Executive Bylaws of Law No. 7 of 2010

Kuwait City, February 4, 2023 - The Board of Commissioners of Kuwait Capital Markets Authority, in its meeting held on 28/12/2022, has approved the deliverables of its project for the development of a regulatory framework for financial technologies (Fintech) related to securities activities. The main deliverable of which was the regulations for financial technologies, which was drafted in the form of a new independent module added to CMA Executive Bylaws’ modules, under the name “Module Nineteen: FinTech”. These regulations focused on the provisions regulating the first set of services specified in the regulatory framework for financial technologies, which are regulations for securities-based crowdfunding services, and digital financial advisory services, as there is a local demand for these services. This initiative was undertaken by CMA due to its belief in the importance of the financial technologies industry and the innovative use of technology in advancing and enhancing financial services and products. The general objective of the project is to introduce regulatory controls and measures in accordance with the best international practices related to FinTechs, ensuring they fall in line with the provisions and objectives of CMA’s Laws of relevance, which shall contribute to the protection of consumers who deal with financial technologies’ services and products. These regulations also aim to protect the rights of entrepreneurs and innovators in the financial technology industry. Deliverables of this project will have a positive impact on supporting Kuwait’s 2035 Vision to transform the State of Kuwait into a regional financial and commercial center, through the promotion and diversification of investment services and products along with providing new investment channels that contribute to diversifying the national economy and achieving financial inclusion.

CMA has implemented a set of procedures that contribute to enhancing the quality of the provisions and rules introduced within the regulatory framework, which aim to reduce and overcome the obstacles that may affect the application process of the rules, and ensure their suitability of the local environment. CMA has always been convinced of the importance of engaging relevant stakeholders to capture their opinions regarding various trends and practices related to the regulation of such FinTech services. Following this, CMA has conducted both external and internal surveys exercises as part of regulations drafting process. CMA has also organized an awareness workshop (remotely - via Zoom) on 03/10/2022 on its initial draft of the fintech regulations, in which many of the related parties participated, along with other concerned persons. The number of participants exceeded 80 persons from both companies licensed to practice securities activities, and public and private entities in the country. The draft included a full explanation of the provisions regulating the first set of services specified for fintech regulations (draft regulations for securities-based crowdfunding services and the digital financial advisor). All the participants inquiries were answered, and an updated version of the draft regulations for financial technologies was prepared after considering the necessary amendments to the initial draft of the fintech regulations, which were based on the constructive feedback captured from internal and external stakeholders.

In this regard, CMA’s regulations for Fintechs defines the securities-based crowdfunding service as a method where small and medium-sized companies can seek funding from the public to fund for their project by offering shares of their capital through a crowdfunding offering. According to this definition, these companies are called "Offer Issuers". CMA’s regulation of this service included controls that organize the relationship between all related stakeholders, which are the crowdfunding platform registered with CMA, the subscription agent concerned with managing the offering, the offers issuers and investors from the public, in accordance with the models available for providing such service, which are as follows:

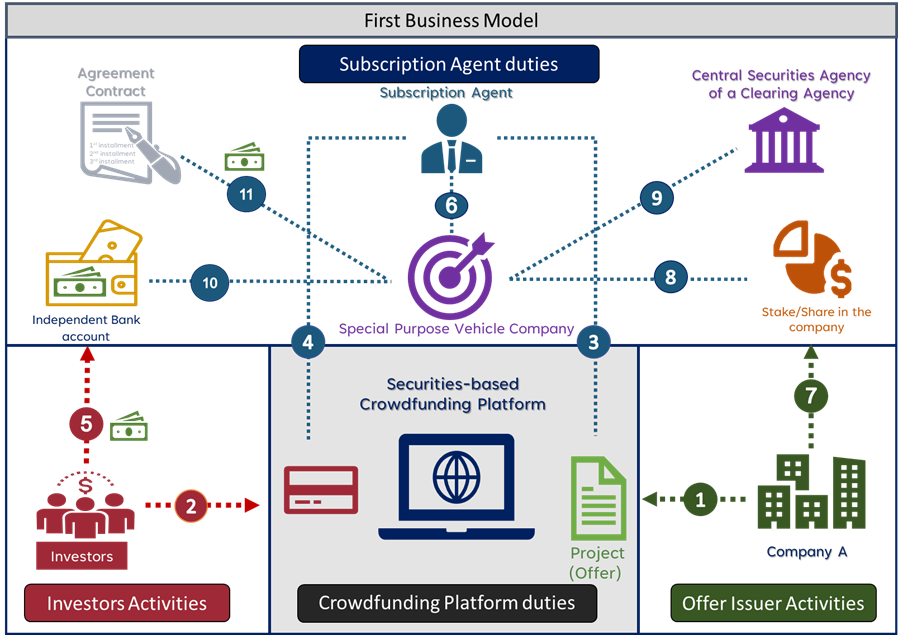

The first model (to be used by companies whose legal form will be either a limited liability or a closed shareholding company after the offering): In this model, the licensed subscription agent associated with the offering will be required to establish a special purpose vehicle (in the form of a closed shareholding company), with the purpose of handling the payments for the project subject in the offering, and act as the indirect ownership of the investors in the company subject of the offer. This model is achieved by having the eligible offer issuer, upon the fulfillment of the offering’s funds target, transfer part of the companies capital in the name of the special purpose vehicle, where then the subscription agent associated with the crowdfunding offering shall allocate the shares of the special purpose vehicle for the investors, after which, the funds collected for the offering shall be deposited in the special purpose vehicle bank account, which will be used for the funding of the eligible project subject of the offering. The following diagram represents an illustration of the first model:

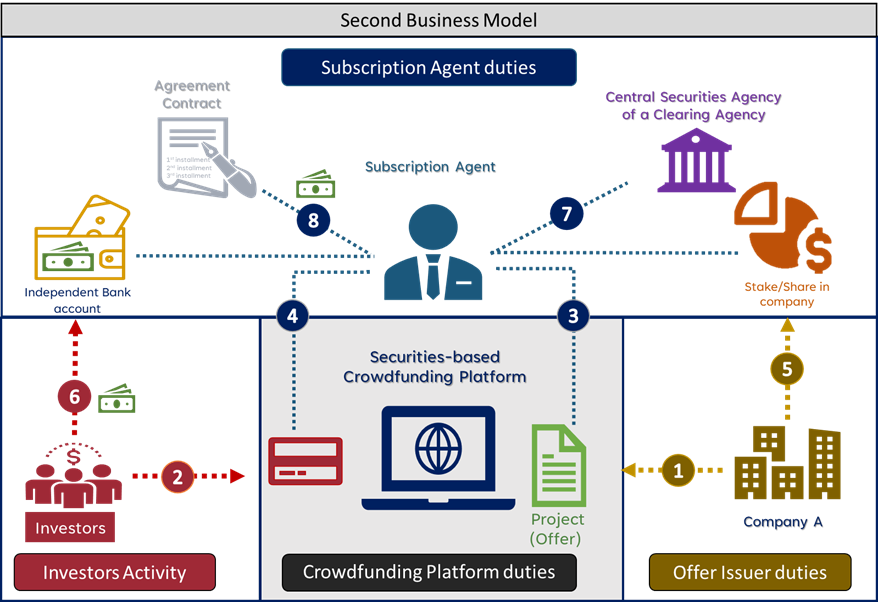

The second model: (to be used by companies whose legal form will be, a partnership limited by shares company or a closed shareholding company after the offering): in this model, the licensed subscription associated with the crowdfunding offering will proceed with the procedures of allocating and registering of securities (shares of the offer issuer’s company) subject to the offering upon the fulfillment of the offering’s funds target. The subscription agent managing the offer shall then fund the project according to the distributed crowdfunding offer document. The following diagram represents an illustration of the second model:

CMA’s regulations on crowdfunding will contribute to providing direct funding channels that bring together investors from the public interested in investing their money in small and medium enterprises, as small investors and entrepreneurs have the possibility to invest their money in businesses that will benefit them financially. CMA’s regulations will also contribute to increasing the level of liquidity in the market by providing alternative financing channels (other than the traditional financing channels) for small and medium enterprises, as well as its contribution towards increasing the awareness and knowledge of the public in the financial and investment sector, which will thereby enhance the financial dealings in the Kuwaiti capital market.

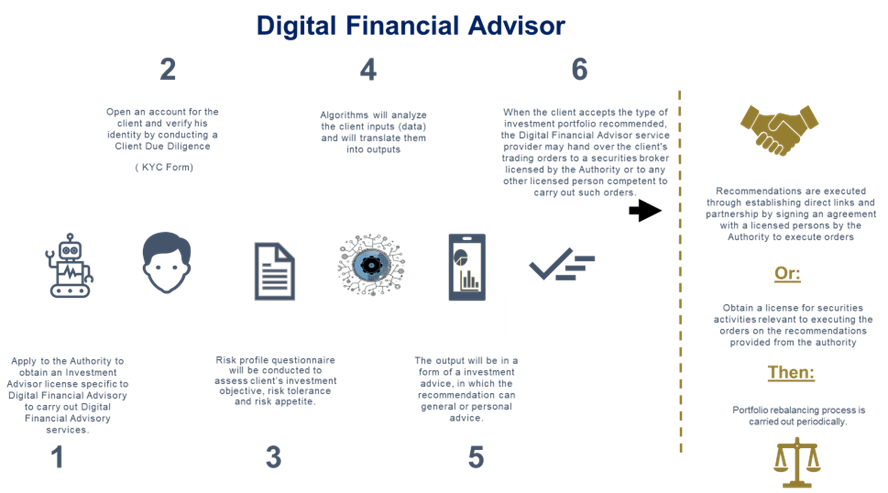

As for the Digital Financial Advisory service, which is one of the services available under the Investment Advisor licensed by CMA, it is a service that focuses on providing financial advice on financial investments and products using algorithms and innovative technologies, with limited or no participation by a human financial advisor. The financial advice provided through this service ranges from advice that is narrow in scope to a comprehensive financial plan that considers the personal information provided by the client in the process of selecting the appropriate investment products and instruments. CMA’s regulations of this service includes the scope and applicable controls in implementing the issued advice through two methods; the Digital Financial Advisory service provider can either establish connections and direct links with licensed persons by CMA, whose license allows them to execute the issued advice and the client orders, or the Digital Financial Advisory service provider can obtain the relevant securities activities’ license/s from CMA to execute such advice. The following diagram represents an illustration on digital financial advisor service:

The financial advisory service in its traditional form is governed by several restrictions which reduce its scope of application and poses limitations that result in catering this service to only high capital accounts. With CMA introducing the Digital Financial Advisory service regulations, and due to the high-capacity algorithms that can accommodate more clients on an timely manner, and no constraints on the amounts to be invested, making it available to a larger scale of the public, this will help achieve wider financial inclusion and contribute in increasing capital flow and the levels of liquidity in the local economy, along with offering additional diversification investment options for investors.

CMA was also keen to include a set of controls and policies in the Fintech regulations that would enhance the quality and efficiency of the service provided and protect investors in this area in several aspects, of which the following represents the most significant of them:

1. Implementing “Know Your Client” precautions, which in turn will contribute to determining the optimal range of services for the client and his investment limits, with the aim of reducing the risks of exposure and client’s reliance on complex financial services and instruments with high financial risks. It will also ensure good management of clients’ funds and help combat money laundering and financing of terrorism.

2. Procedures for verifying the client’s identity before opening an account or establishing a business relationship with the client; as service providers will now be allowed to carry out procedures for verifying the client’s identity electronically using any modern means of communication, without the need to meet the client in person, provided that it does not affect the integrity of the process and the ability to properly qualify the investor.

3. Applying policies to protect the confidentiality of client’s information, and applying cybersecurity precautions and guidelines to limit breaches, in accordance with the best international applications and policies in this area.

4. Continuous follow-up by CMA towards ensuring that the relevant financial technology service platforms apply the tests that identify and help reduce the risks to which the clients might be exposed to.

5. A set of limits and restrictions have been imposed on crowdfunding offerings, in the form of a limit of 500,000 Kuwaiti Dinars set as the maximum amount to be raised in a single crowdfunding offering, along with restrictions on the number of crowdfunding offering rounds that are allowed in a single year. CMA seeks to revisit these limits and restrictions in the future and gradually amend them, which will be dependent on the level of maturity and awareness of service providers and the investors, and the general success of the crowdfunding offerings.

CMA has issued and published Module Nineteen (FinTech), to be implemented as of January 2024, in order to provide the opportunity to establish the necessary internal operational and regulatory controls necessary for its successful implementation in addition to allowing for sufficient time to raise awareness and educate the market on various aspects of the regulations.

Ends-

Notes to Editors:

The Capital Markets Authority was established pursuant to Law No. 7/2010, approved by the Kuwaiti Parliament in February 2010. Pursuant to the Law, CMA shall regulate and supervise the securities activities, achieve transparency and fairness, observe listed companies’ execution of Corporate Governance regulations, and protect investors from unfair practices which violate CMA's Law.

Furthermore, the Law's provisions stipulate the supervision of mergers, acquisitions, and disclosure operations. CMA also aims to provide awareness programs related to securities activities.

For further information, please contact:

Public Relations & Media Office

Tel: 22903062

Fax: 22903505

CmaSideNavigation

In this section

We use cookies to ensure you get the best experience on our website.